- [email protected]

- (403) 315-1961

Your Trusted Partner in Mortgages. Offering Reliability, Expertise, and Tailored Solutions

Start your home buying journey with a Mortgage Professional and let us guide you through your mortgage process.

With a passion for helping individuals and families achieve their homeownership dreams, Lynda brings a wealth of experience and expertise to the mortgage industry. Known for her personalized approach to each client’s unique financial situation, Lynda takes pride in providing tailored solutions that meet both short-term needs and long-term financial goals. Whether you’re a first-time homebuyer seeking guidance, or a seasoned investor looking to expand your portfolio, Lynda offers comprehensive advice and support throughout the entire mortgage process.

Buying an investment property is a popular option for Canadians looking at different ways to invest their money. We help you source the best opportunities for your needs and goals, which we tailor to you and your portfolio. Available finance options can include:

When you’re a first-time home buyer, the process can feel exciting and a little scary. But if you do a little homework beforehand, buying your first home can be fun and rewarding.

Through this program, we can help new Canadians purchase their first home, build equity, and become economically established in Canada.

A self-employed person is someone who works for themselves and does not earn a fixed salary or wage from a third-party employer. While this form of employment can bring many benefits, it can also present some hurdles when it comes to buying a home.

Are you looking to consolidate your debt, pay for a child’s education, renovate your home, or would like to lower your mortgage payment? There are many options available to pull equity out of your home when you need it.

Your financial needs as well as the market changes over time and so should your mortgage. When your mortgage is up for renewal, this is the best time to re-evaluate what you want from a mortgage and shop around for the best products and rates.

Over the last 30 years, Canada has seen significant fluctuations in mortgage rates as well as numerous changes to financing rules and regulations. When it comes to finding the best rate and mortgage solution tailored to your needs, Lynda is your guide.

With Lynda’s expertise, she doesn’t just focus on rates. She invests time to understand your unique situation, ensuring the perfect mortgage fit for you. She’ll walk you through every step of the process, making it seamless.

Instead of navigating this complex process alone, give Lynda a call. Sit down with her, explore the numbers, and discover how her personalized approach can make your dream of homeownership a reality.

As a seasoned broker, Lynda holds the ability to consult with multiple banks, credit unions, and lenders meaning you get access to a wide range of options, ensuring the perfect fit for your needs.

With strong contacts and established relationships, she gets things done efficiently. Her brokerage network grants you access to exclusive rates and terms that you might not find elsewhere.

To create accessibility and convenience in securing financing for all individuals, enabling them to fulfill their homeownership dreams.

Prioritize service quality and customer satisfaction by offering an efficient, competitive, and hassle-free mortgage experience.

Unlocking Homeownership Dreams Together. Providing innovative, affordable, and tailored housing finance solutions that meet our clients needs.

From first-time homebuyers to retirees, self-employed individuals to real estate investors Lynda and her expert team make getting your mortgage simple and easy!

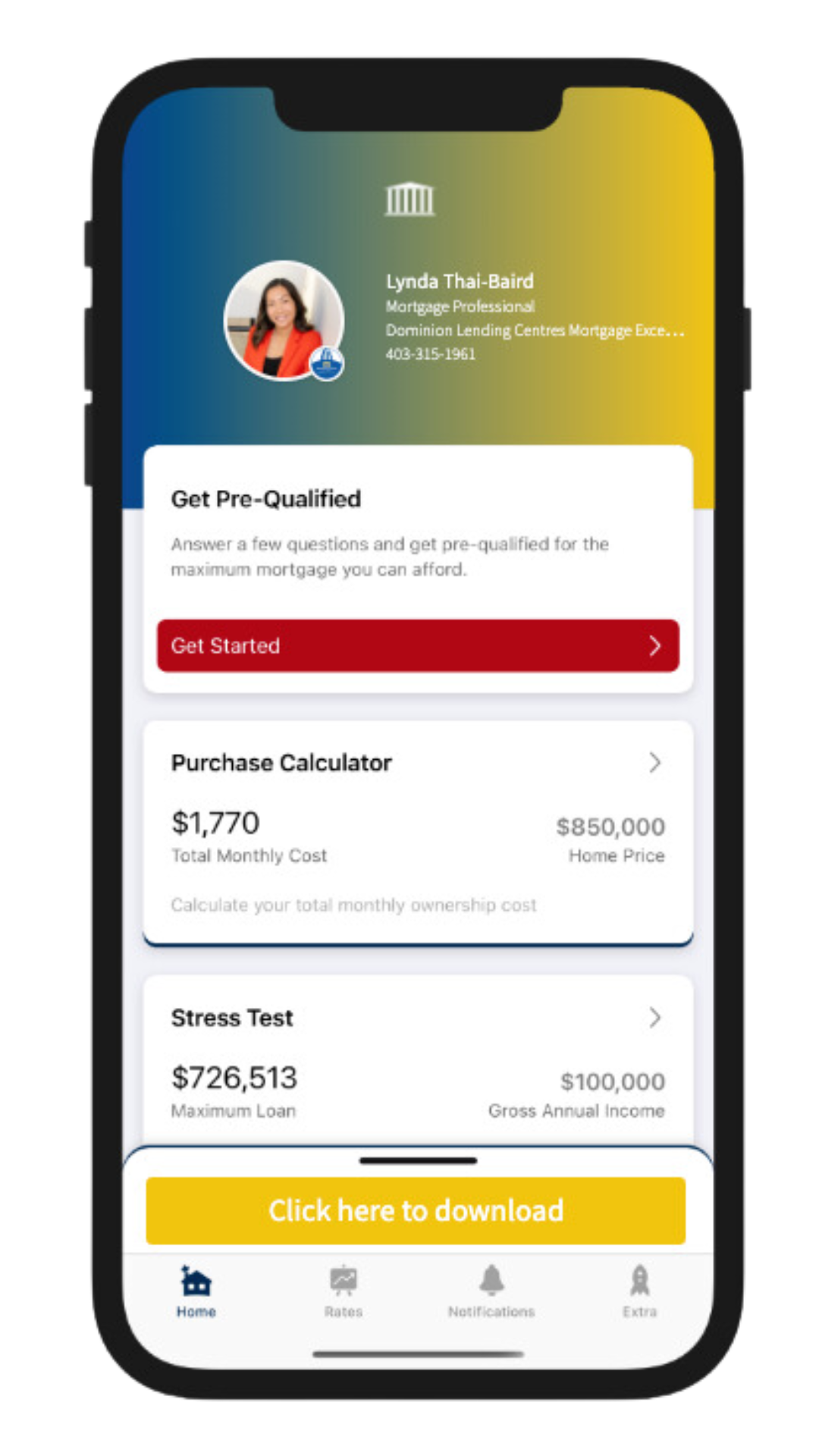

Whether you are looking to get pre-qualified for a new mortgage, or are renewing or refinancing an existing mortgage, the first step is to complete an application.

To make it convenient, we offer our clients three options:

1. Online

2. Over the phone

3. In-person.

Once your application and credit consent is received, we will send you a list of documents needed to ensure we are providing you with the most accurate information. We will determine your maximum purchase price, review available rates, and discuss your required down payment and closing costs. When you receive your pre-qualification, you can start moving forward, whether that’s making an offer on a new home, or shopping for mortgage financing approvals.

We work tirelessly to match you with the perfect bank or lender that suits your needs and lifestyle. Once your options are identified, we will submit to the lender of your choice and structure your mortgage in a way that works best for you.

At this stage you will receive a mortgage commitment from the lender outlining the terms of the mortgage and identifying any additional things the lender needs to review to finalize your approval. We will also take the time to help you understand your approval and address any questions or concerns you may have.

Congratulations, your mortgage is officially complete and finalized! The only remaining step is a meeting with a lawyer or title company to register your new mortgage onto your home's title.

EXCELLENTTrustindex verifies that the original source of the review is Google. Lynda and her team were amazing to work with as I was a first time homebuyer. They were very professional, personable, and made the whole mortgage process simple and easy. I felt like they had my best interests in mind, and secured the best mortgage option for me in a challenging rate environment. I highly recommend them and I would not hesitate to use them in the future.Posted onTrustindex verifies that the original source of the review is Google. Lynda was absolutely fantastic to work with. She responded immediately to every question, and was knowledgeable and kind in her responses. She went beyond the role of a broker and made a home purchase so easy, especially for someone like myself with little knowledge about the process. She was not judgemental or pushy in any way. I wholeheartedly recommend working with her.Posted onTrustindex verifies that the original source of the review is Google. Lynda worked with me for months while I asked questions about the best plan to sell one house and buy another during the recent dramatic interest rate inflation. She recommended an awesome realtor to work with and between the 2 of them sold my house and found me another. They made this whole process painless and seamless. I have nothing but glowing comments to make about them both. Thanks Lynda, I really appreciate the work you did and the help you gave.Posted onTrustindex verifies that the original source of the review is Google. Very easy for a first time home buyers, explained every step and answerd all my questions. Highly recommend very knowledgeablePosted onTrustindex verifies that the original source of the review is Google. Lynda helped us through all, explaining every detail of the process. She was very kind, professional, and helpful all the time. Lynda and her team did their best to help us to make a good deal, based on the rates and banks that we could choose. Thank you so much Lynda!!Posted onTrustindex verifies that the original source of the review is Google. Lynda was very professional and great to work with when it came to purchasing my house in Lethbridge. I would highly recommend Lynda and her company because they really work hard to make this process as least stressful as possible. Anyone looking to go through this process should really consider using Lynda.Posted onTrustindex verifies that the original source of the review is Google. Lynda was very professional and thorough. All our difficult questions were answered and she bent over backwards to ensure we were well informed. We felt like Lynda had our best interests in mind and we well taken care of.Posted onTrustindex verifies that the original source of the review is Google. Lynda Thai-baird is the ultimate professional. Her knowledge and experience helps all my clients get the best rate and quality service. I will continue to recommend her to my clients friends and family.Posted onTrustindex verifies that the original source of the review is Google. I had the opportunity to sit in on a presentation given by Lynda she is a polished presentor, very informative and provided additional resources for us to access on at our convenience.Posted onTrustindex verifies that the original source of the review is Google. We recently reached out to Lynda when our Mortgage was up for renewal. She was responsive, helpful and thorough in her advice to us. She quickly did research and was able to come with some sound information that helped us make a decision on next steps. Lynda was kind, honest and did not try to influence us one way or another. Her professional approach and style are key reasons anyone should consider her for Mortgage support.

We have access to a wide variety of lenders — which allows us to find a mortgage solution that’s right for you.